Published on www.moderneconomist.in | By Mihir Tadvi (Founder Of ModernEconomist.in)

India is estimated to lose over $200 billion annually due to black money stashed offshore. While traditionally viewed as a liability, this untracked wealth presents an extraordinary opportunity if leveraged wisely. What if we could regulate, not chase? Legalize, not penalize?

The answer lies in the Global Digital Remittance System (GDRS) a secure, transparent, and technology-driven framework to convert informal capital into legally usable economic power. This is not just about reform it’s about resurrection.

What is GDRS?

The Global Digital Remittance System (GDRS) is a proposed digital mechanism to legalize and regulate informal cross-border capital flows commonly known as Hawala. Supervised by the Reserve Bank of India and the Ministry of Finance, GDRS aims to:

Objectives:

• Enable regulated remittance of untaxed wealth.

• Use blockchain and AI tools to ensure secure, traceable transactions.

• Avoid burdening India’s domestic banking system.

• Enhance forex reserves and improve economic productivity.

Key Features of GDRS:

1) AI + Blockchain-based Compliance Checks Automates legal verification while ensuring privacy and traceability.

2 Global Intermediary Partnerships Leveraging BRICS nations, CBDC infrastructure, and SWIFT alternatives like China’s SPFS.

3) INR-Eurodollar Integration For seamless capital flow, cross-border confidence, and macroeconomic stability.

4) NRI & Offshore Apps Dedicated platforms for voluntary disclosures, asset conversion, and real-time tracking.

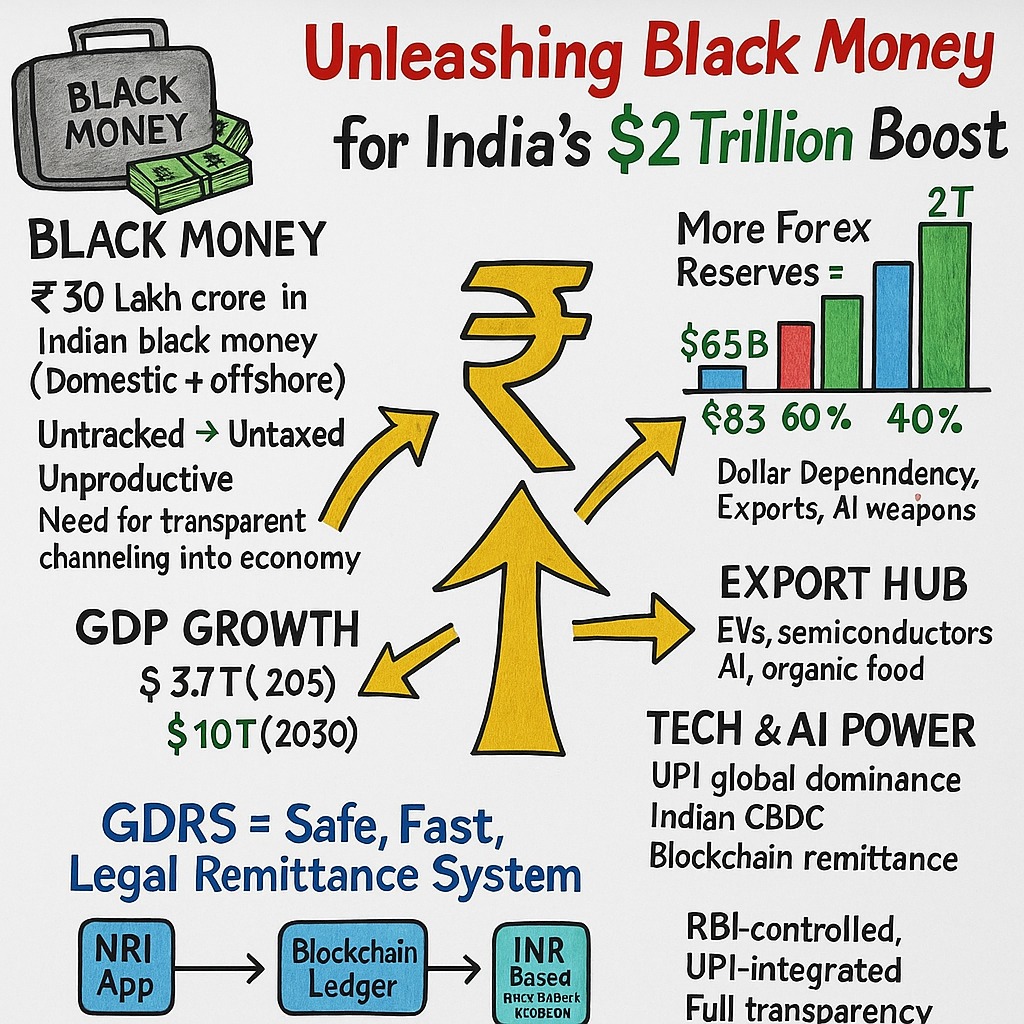

Expected Outcome: The $2 Trillion Boost!

India’s black money pool is estimated at ₹30 Lakh Crore. GDRS could unlock:

• $650B+ in forex reserves

• 3.7T GDP by 2030 (through investments in AI, EVs, semiconductors)

• Increased export strength and decreased dollar dependency

This system would position India as an export and technology hub, driving clean energy, blockchain finance, and AI-powered trade.

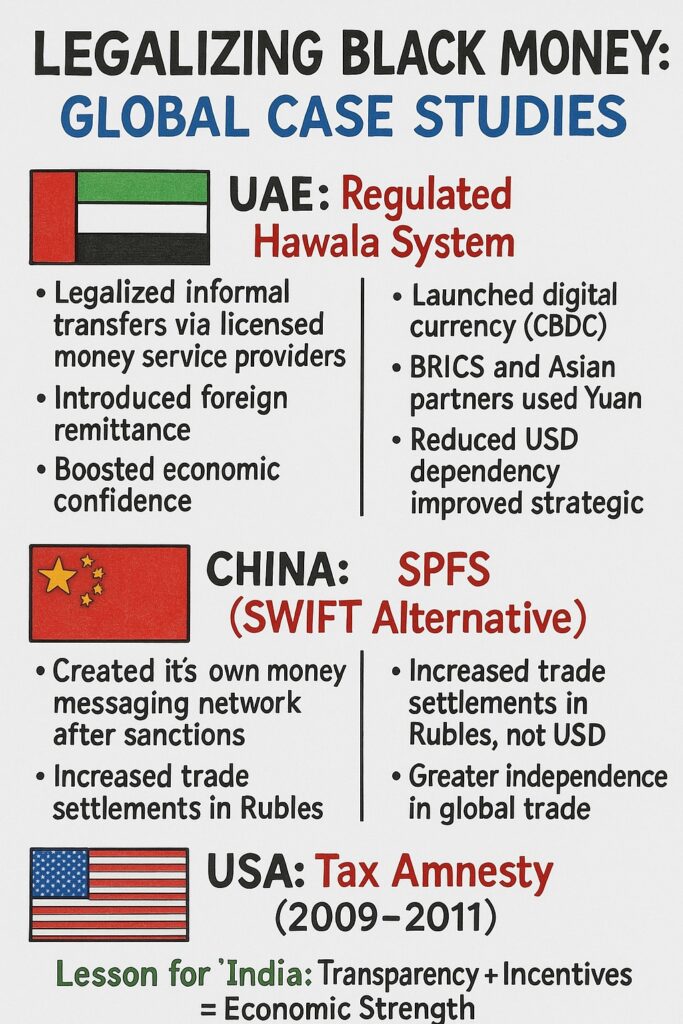

Global Case Studies: Lessons from the World.

Countries like the UAE, China, and the USA have successfully turned informal or untaxed capital into formal economic drivers. The UAE’s regulated Hawala system provided a secure way to channel informal remittances. China countered SWIFT restrictions by building SPFS, enabling Ruble-based international trade. Meanwhile, the USA’s Tax Amnesty (2009–2011) reclaimed $3.4B+ from offshore accounts by offering a mix of transparency and incentives.

India can adopt a similar playbook leveraging technology and policy to transform black money into national strength.

Background & Justification:

India is estimated to hold over $500 billion in unaccounted offshore wealth. Left untouched, it’s a dead asset. But GDRS offers a lifeline converting this into productive capital via voluntary disclosures, smart contracts, and legal gateways.

This approach will:

• Strengthen the rupee’s global role

• Increase NRI confidence

• Reduce dependence on FDI & volatile capital flows

Conclusion: Legalize. Invest. Lead.

The time has come for India to stop running from black money and start leading with it. With GDRS, we don’t just clean up past wrongs we build a future powered by innovation, transparency, and legal prosperity.

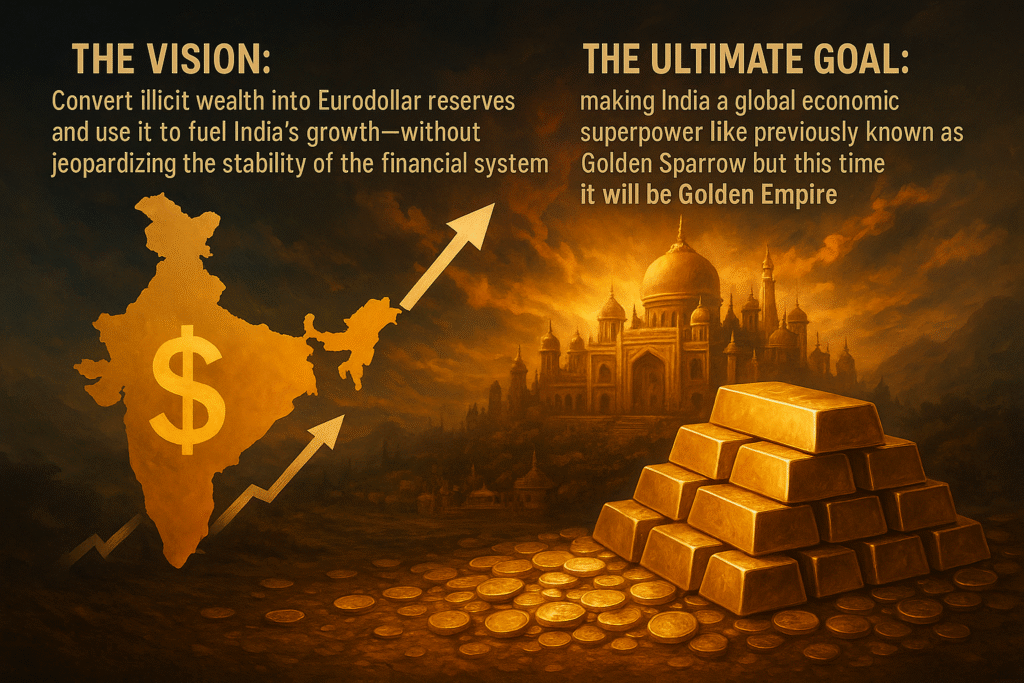

It’s not about forgiving the past. It’s about shaping a Golden Empire one policy, one dollar, one vision at a time.

Drawing inspiration from global models like UAE’s Hawala regulation and the US Tax Amnesty, GDRS leverages AI, blockchain, and INR-Eurodollar integration to build India’s forex reserves without burdening domestic markets.

This bold yet practical vision aims to elevate India from the “Golden Sparrow” of the past to the Golden Empire of the future.

Mr. Tadvi invites ministry officials and economic policymakers to review this transformative blueprint and collaborate on reshaping India’s global economic power.